June 10, 2024

Reporting your Beneficial Ownership Information (BOI) Reporting is a fundamental requirement for all business owners. In September 2022, the Financial Crimes Enforcement Network (FinCEN) implemented the BOI report as part of the Corporate Transparency Act; requesting most corporations and LLCs in the United States to report identifying information. This measure aims to promote financial transparency and detect illicit activities within the corporate landscape. Therefore, it must be taken very seriously, as non-compliance could be considered a crime.

Here’s all you need to know:

What is BOI Reporting?

BOI reporting involves disclosing information about those who own, control, or establish corporations and LLCs. It requires divulging details about beneficial owners, defined as individuals who:

- Exercise substantial control

- Run 25% or more of the company

- Receive significant economic benefits from its assets.

Should I File My BOI Report Annually?

A single filing is required unless there are subsequent alterations to any provided information. Companies formed between January 1, 2024, and January 1, 2025, must file their BOI report within 90 days of formation, while existing companies have until January 1, 2025. Companies formed after January 1, 2025, have only 30 days from the date of formation to file their BOI report.

Should there be any modifications to the required details regarding the company or its beneficial owners in a BOI report that was submitted, the company must submit an updated BOI report within 30 days of the change.

Penalties for Non-Compliance

The penalties for non-compliance are severe. Intentionally failing to file or providing false information can lead to fines up to $10,000, civil penalties up to $250,000 for individuals, and $500,000 for organizations. In some cases, you could even face up to three years in prison.

How to File It

1. Gather the Necessary Information

For reporting companies:

- Full company name

- Any trade name or doing business as (DBA)

- Business street address

- Jurisdiction where the company was formed

- IRS tax ID number

For beneficial owners:

- Full legal names

- Dates of birth

- Current residential or business addresses

- Images of government-issued ID cards (passport, driver’s license, etc.)

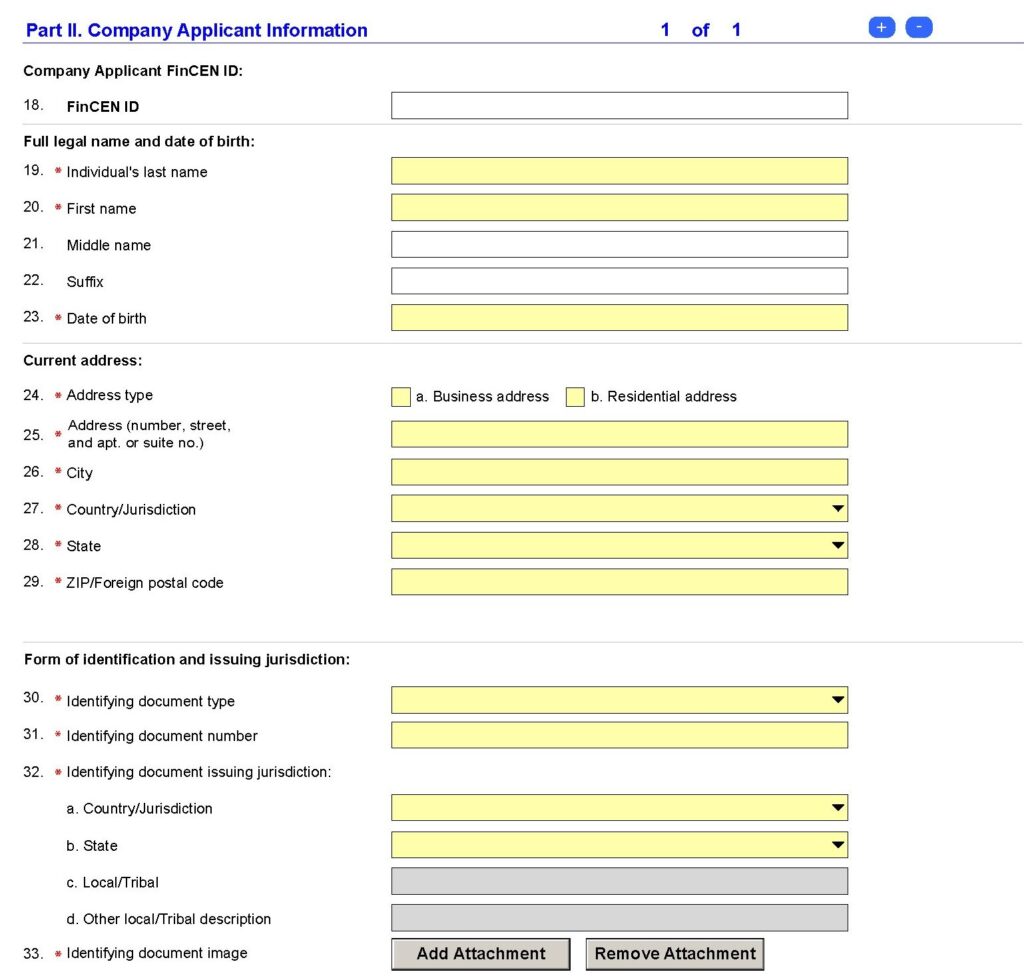

2. Complete the Form at the FinCEN Reporting Portal

Visit the Financial Crimes Enforcement Network (FinCEN) website. If you haven’t registered previously, create an account on the FinCEN Reporting Portal, or log in using your credentials. Choose the option to file a new report or update an existing one (depending on your company’s status) and fill in the required details.

Click here to read FinCEN’s official guide in case you have any doubts.

3. Review the Information

Double-check all entered information for accuracy and completeness, and verify that the details provided align with the requirements outlined by FinCEN and the Corporate Transparency Act. This last step may require the assistance of a professional, so consider consulting your accountant for extra safety.

Once you are done, submit the completed report through the portal, and you should receive a confirmation or acknowledgment of the filing. Don’t forget to keep a copy of the filed report and any related documentation for your records, just in case.